Realiste Head Office

Dubai, Central Park Towers, DIFC level 16: Office 16-36

Contact us

Article by Alex galt

10 Dec 2023

10 Dec 2023

The $1 trillion AI revolution in Real Estate is happening now. How to profit from it?

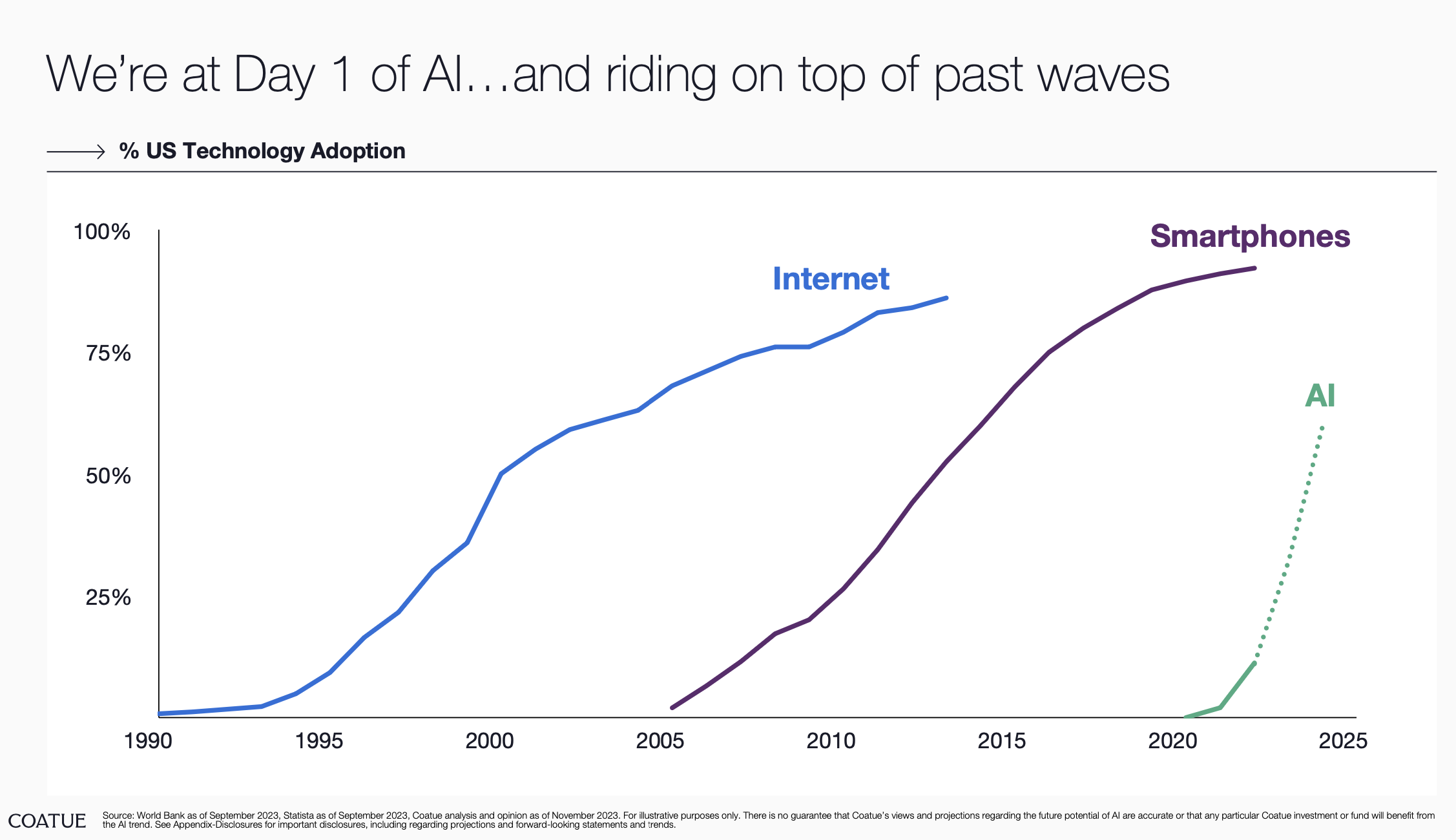

Artificial Intelligence is soaring and growing at a rate several times faster than the Internet and smartphones. Is AI just a hype? Drawing upon eight years of experience in real estate AI, along with insights from numerous studies and reports, this article by Alex Galt offers unique perspectives that can't be found elsewhere. With demonstrated benefits, AI is positioned to endure and redefine various markets in the coming years.

5 Brief Theses on How AI Will Impact Real Estate and All of Us:

- $1 trillion in investments will be redistributed among cities over the next approximately 5-10 years.

- Over 30% of realtors will change their jobs.

- Up to 100 million people globally will relocate in 5-10 years.

- Tens of thousands of new dollar millionaires will emerge soon.

- Over the next five years, AI will act as a catalyst for creating approximately 100 new billionaires, free humanity from many unnecessary actions, and facilitate the redistribution of resources into new areas vital for humanity.

New Opportunities That Didn't Exist Before

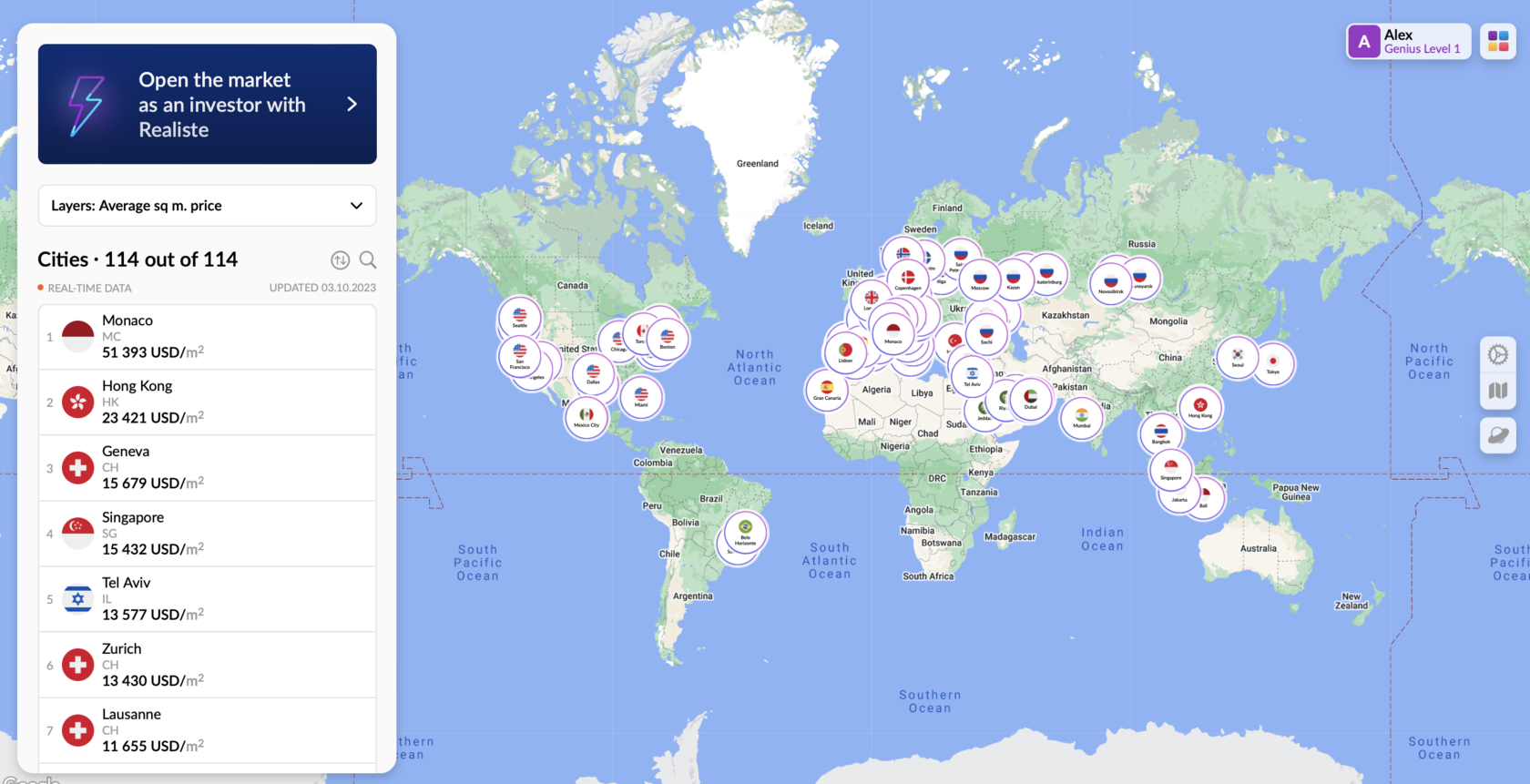

Most people buy real estate where they were born or where they have lived most of their lives. The lack of data on other locations and opportunities narrows people's choices to what they know and understand. Although at any given moment there are the top 10% of cities or locations in the world that are the best to live or invest in, logically 90% of people are unaware of this, otherwise, they would be buying real estate exactly there. Thus, in real estate, there exists a global geographical arbitrage worth trillions of dollars

In London's cheapest area, Barking, average prices are $6161 per square meter for low-quality real estate, located 1 hour away from the city center in a high-crime area with a 35%+ tax and $6000 live spending/m. In contrast, the neighborhood "Hartland" in Dubai, just 10 minutes from the city center with zero crime, zero tax, and $4000 live spending/m, offers business-class homes (pool, doorman, gym, lobby) at $6225 per square meter. The cost difference is substantial, with the price/quality ratio showing a 300% difference between these locations. This suggests that property owners in Barking could potentially sell their houses, buy three similar ones in Dubai, rent out two of them, and achieve financial independence through rental income.

Most people buy real estate where they were born or where they have lived most of their lives. The lack of data on other locations and opportunities narrows people's choices to what they know and understand. Although at any given moment there are the top 10% of cities or locations in the world that are the best to live or invest in, logically 90% of people are unaware of this, otherwise, they would be buying real estate exactly there. Thus, in real estate, there exists a global geographical arbitrage worth trillions of dollars

In London's cheapest area, Barking, average prices are $6161 per square meter for low-quality real estate, located 1 hour away from the city center in a high-crime area with a 35%+ tax and $6000 live spending/m. In contrast, the neighborhood "Hartland" in Dubai, just 10 minutes from the city center with zero crime, zero tax, and $4000 live spending/m, offers business-class homes (pool, doorman, gym, lobby) at $6225 per square meter. The cost difference is substantial, with the price/quality ratio showing a 300% difference between these locations. This suggests that property owners in Barking could potentially sell their houses, buy three similar ones in Dubai, rent out two of them, and achieve financial independence through rental income.

With thorough data gathering and understanding of people's behavioral strategies, there may be opportunities for low-risk, high-reward trading in the real estate market.

And this is not just an example of Dubai and London. On the platform, you can find hundreds of similar examples in 114 cities, with over 20,000 neighborhoods where you can move from a less desirable neighborhood in an old city to a fantastic neighborhood in a new or lesser-known city and receive a substantial cash bonus. Moreover, the safety and infrastructure at the new location may be even better.

And this is not just an example of Dubai and London. On the platform, you can find hundreds of similar examples in 114 cities, with over 20,000 neighborhoods where you can move from a less desirable neighborhood in an old city to a fantastic neighborhood in a new or lesser-known city and receive a substantial cash bonus. Moreover, the safety and infrastructure at the new location may be even better.

AI is crucial for identifying the most promising real estate markets and opportunities by analyzing vast data sets, offering insights that human analysts cannot match in predicting growth across numerous neighborhoods and cities.

How to Profit from This

Currently, only a small number of people are aware of the existence of AI in real estate, giving a significant advantage over the market and other participants. However, in a couple of years, these opportunities will become more commonplace, and the potential income from their use will become more modest. As more people begin to utilize these tools, the advantage of their individual use will diminish.

Below, I outline what I believe are the most promising opportunities for profiting in this field:

In real estate, AI opens up two intriguing investment strategies that were previously nearly inaccessible. Each of these strategies has the potential to grow capital from $1 million (insert your amount) to 10 times that amount (up to $10 million) throughout 5 to 10 years.

Currently, only a small number of people are aware of the existence of AI in real estate, giving a significant advantage over the market and other participants. However, in a couple of years, these opportunities will become more commonplace, and the potential income from their use will become more modest. As more people begin to utilize these tools, the advantage of their individual use will diminish.

Below, I outline what I believe are the most promising opportunities for profiting in this field:

In real estate, AI opens up two intriguing investment strategies that were previously nearly inaccessible. Each of these strategies has the potential to grow capital from $1 million (insert your amount) to 10 times that amount (up to $10 million) throughout 5 to 10 years.

Strategy 1 - Buying at a Discount and Reselling at Market Price

You can use AI to identify real estate properties that are selling at a discount or considered overvalued. After purchasing such real estate and waiting for its value to increase, you can resell it at market price, generating a profit.

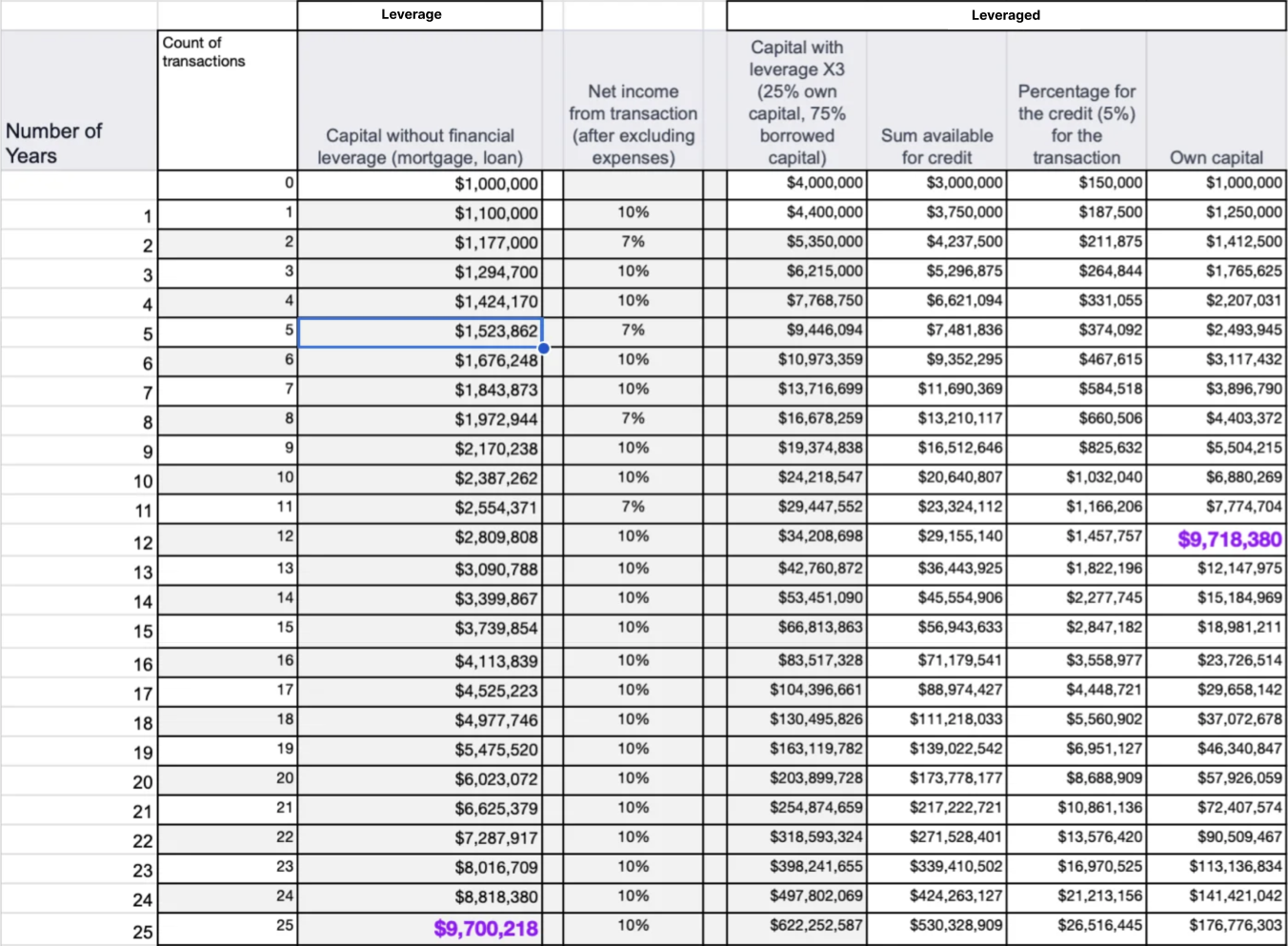

The essence of the strategy is to find real estate that is priced 15% below the market value: 10% for profit and 5% to cover transaction costs and taxes. Regardless of market fluctuations, the goal is to sell such real estate at its market value. The faster the sale occurs, the better: if the cycle takes not a year but 6 months, you can increase the amount from $1 million to $10 million in 25 transactions, or in 12 years. With the use of financial leverage, this can be achieved in 12 transactions and in 5-6 years. Real estate can be found and sold without making improvements; you can calculate the value after renovations, taking into account investments - this is not essential. The key point is that AI can calculate this more efficiently and is already actively doing so.

Please note that taxes and expenses related to the sale or search for such real estate should be added on top of your calculations (I didn't mention this because different markets have different expenses and taxes).

AI can and is already being used to create a real estate pipeline with discounts. This is achieved through automated valuation models, where each property entering the market undergoes an assessment and enters the pipeline.

However, after five years of working on AI development, we have concluded that such a business model may seem dull. It requires a lot of movement and activity and is often more suitable for small companies. When working with a substantial amount of data, a large number of human resources is needed. Moreover, such models are rarely funded by banks, and non-banking capital is not always available in many countries around the world. For example, in Russia or the UAE, there are no financial products similar to Hard Money Loans, representing a $30 billion industry in the US.

You can use AI to identify real estate properties that are selling at a discount or considered overvalued. After purchasing such real estate and waiting for its value to increase, you can resell it at market price, generating a profit.

The essence of the strategy is to find real estate that is priced 15% below the market value: 10% for profit and 5% to cover transaction costs and taxes. Regardless of market fluctuations, the goal is to sell such real estate at its market value. The faster the sale occurs, the better: if the cycle takes not a year but 6 months, you can increase the amount from $1 million to $10 million in 25 transactions, or in 12 years. With the use of financial leverage, this can be achieved in 12 transactions and in 5-6 years. Real estate can be found and sold without making improvements; you can calculate the value after renovations, taking into account investments - this is not essential. The key point is that AI can calculate this more efficiently and is already actively doing so.

Please note that taxes and expenses related to the sale or search for such real estate should be added on top of your calculations (I didn't mention this because different markets have different expenses and taxes).

AI can and is already being used to create a real estate pipeline with discounts. This is achieved through automated valuation models, where each property entering the market undergoes an assessment and enters the pipeline.

However, after five years of working on AI development, we have concluded that such a business model may seem dull. It requires a lot of movement and activity and is often more suitable for small companies. When working with a substantial amount of data, a large number of human resources is needed. Moreover, such models are rarely funded by banks, and non-banking capital is not always available in many countries around the world. For example, in Russia or the UAE, there are no financial products similar to Hard Money Loans, representing a $30 billion industry in the US.

Pros of the strategy:

- It is possible and works in any market, especially where there are no or deferred capital gains taxes (e.g., the 1031 exchange in the United States or in the UAE before the introduction of the 9% profit tax in 2023).

- Particularly effective in markets with well-developed financing options for such deals, such as the United States, England, Australia, and others

- Continuously searching for such properties without software assistance can be challenging since there are not many property owners willing to sell at a 15% discount.

- It requires a high volume of transactions to grow capital, which can be resource-intensive.

Strategy 2 - Smart Market and Project Selection

The second strategy that can lead to an increase in capital from 1 million to 10 million dollars involves making the right choices for just two projects over 10 years. This means selecting a market where the growth over 5 years would be approximately as follows:

For example, Dubai's real estate market has been demonstrating an average annual price growth of 15% since 2020. Currently, in 2024, the growth is around 11%. Some projects in Dubai have shown growth of 400% since 2020. The best projects within the top 10% over the last 4 years have exhibited an average annual growth rate of more than 30%. This Dubai example illustrates that finding a market and project with high growth rates is entirely possible with the right choices while avoiding risks related to defaults or property destruction.

Taxes and expenses related to the sale or search for such property should be added on top of these calculations.

The second strategy that can lead to an increase in capital from 1 million to 10 million dollars involves making the right choices for just two projects over 10 years. This means selecting a market where the growth over 5 years would be approximately as follows:

- 15% in the first year,

- 15% in the second year,

- 11% in the third year,

- 7% in the fourth year,

- 5% in the fifth year.

For example, Dubai's real estate market has been demonstrating an average annual price growth of 15% since 2020. Currently, in 2024, the growth is around 11%. Some projects in Dubai have shown growth of 400% since 2020. The best projects within the top 10% over the last 4 years have exhibited an average annual growth rate of more than 30%. This Dubai example illustrates that finding a market and project with high growth rates is entirely possible with the right choices while avoiding risks related to defaults or property destruction.

Taxes and expenses related to the sale or search for such property should be added on top of these calculations.

Under such a strategy, it's crucial to make two correct project selections over 10 years. The actions involve:

Important Notes:

In both the first and second strategies, it's crucial to:

Conclusion

Can AI significantly increase the chances of successfully selecting the market and project? Absolutely. By analyzing all markets and projects, AI can compare prospects in different locations, which is not feasible for humans due to the vast amount of information. AI can also predict when the market's potential is diminishing and it's time to exit a project. This becomes noticeable in advance on the AI's dashboard and forecasts regarding market and project prospects.

In my estimation, by 2025, more than 50% of users will already be informed about AI in real estate. By 2030, not using AI in real estate decision-making will be as unusual as driving without a navigator is today. By that time, the quality of AI recommendations and insights will either be on par with the top 1% of experts or even surpass them.

Creating AI in real estate, as Realiste did, is challenging due to the scarcity and complexity of data. The process requires overcoming obstacles related to data quality and abundance, making it a complex endeavor that not everyone has accomplished.

If you're interested in AI in real estate and want to learn more, feel free to reach out to our founding team.

- Buying one property and, after a year, evaluating it to gain extra funds from its increased value. You then purchase another property in the same market (or project) and continue this process for five years.

- In the fifth year, you sell everything and invest in market #2 (or project #2), and repeat the process for another five years.

Important Notes:

In both the first and second strategies, it's crucial to:

- Make the right project selection.

- When buying during the construction phase, avoid defaults (choosing markets with escrow accounts is one option).

- Consider entrusting additional due diligence of the developer to AI, which can reduce these risks but not eliminate them.

- Refinance promptly and buy additional properties in the same project when necessary.

Conclusion

Can AI significantly increase the chances of successfully selecting the market and project? Absolutely. By analyzing all markets and projects, AI can compare prospects in different locations, which is not feasible for humans due to the vast amount of information. AI can also predict when the market's potential is diminishing and it's time to exit a project. This becomes noticeable in advance on the AI's dashboard and forecasts regarding market and project prospects.

In my estimation, by 2025, more than 50% of users will already be informed about AI in real estate. By 2030, not using AI in real estate decision-making will be as unusual as driving without a navigator is today. By that time, the quality of AI recommendations and insights will either be on par with the top 1% of experts or even surpass them.

Creating AI in real estate, as Realiste did, is challenging due to the scarcity and complexity of data. The process requires overcoming obstacles related to data quality and abundance, making it a complex endeavor that not everyone has accomplished.

If you're interested in AI in real estate and want to learn more, feel free to reach out to our founding team.

About Realiste

The company's goal is to create super intelligence (smarter than any human, real estate agent, or analyst, with access to 10,000 times more data and covering 100 times more cities) in the real estate market. The idea is to provide this AI to users for free (open access to some features, full functionality to be provided to B2B partners), while earning revenue through B2B channels (commissions from sales, integrating AI into businesses). The business model resembles that of Google. Currently, Realiste's platform includes data for 114 cities worldwide, 20,000 annotated districts, 20 macroeconomic indicators, and in the UAE, there are 20 layers of data and cross-sections (rental ROI, prices, green area, forecasts, etc.), 15 ratings for over 200 developers and 700 projects. Every day, over 2 million ads pass through the Realiste engine. All this data is updated either daily or weekly (for macro data), and all of it is free, used by our AI to provide forecasts and recommendations to clients. Our products are currently used by developers and banks, and there are free products for users. Realiste currently holds the world's largest real estate database (excluding the United States).

Brief Development History

I started betting on algorithms against human expertise in 2015 when I encountered the limitation of my investment analytics being confined to knowledge of just one district. Real estate agents were similarly restricted to one location (the same person could not provide accurate information about two different districts or two cities), and in 90% of cases, the expertise of real estate agents in investments was lacking. At that time, I had a real estate agency and was investing in land plots. Initially, like many others, it was a complex Excel spreadsheet with hundreds of variables. Then, with the help of developers, we transformed it into products. By 2019, we were putting all our efforts into training our first ML model.

We developed parallel models for different cities: New York (and 10 other cities in the US), Moscow, and Hong Kong as we traveled the world and studied the experiences of these locations.

From 2015 to 2020, we attempted to attract investments into this idea and were unsuccessful in securing VC investments anywhere (we pitched about 250 times, even multiple times to some because they forgot about us, and I pitched to one guy from the largest VC fund in the US three times in five years).

At the beginning of the pandemic, we returned from the US to Moscow and launched an open product in Moscow (users could find apartments in Moscow at 15% below market prices). This product attracted many users, and it was these users who invested money in the company.

A total of 60 angel users of the platform invested over 6 million dollars from 2020 to 2023 and continue to invest in the company. We came up with the idea of integrating AI into banks and developers in Russia, and we spent two years trying to do so. In two years, we integrated AI into various products in the 20 largest companies and earned only 10 million rubles (which wasn't worth the effort, of course). Meanwhile, users continued to use our platform and invest money in us.

Then the war in Ukraine happened, and we decided to leave for Saudi Arabia (because we always wanted to build an international business, and it was no longer possible to do so from Russia). We abandoned everything we had done in Russia (there wasn't much to leave behind, and integrating AI into banks and developers wasn't what a startup should be doing in Russia). At that moment, we were offered to sell 15% of the company in Dubai (where we had no initial plans to develop) for $700,000 and launch a product in Dubai. We launched the product in Dubai, came to adapt, and realized that Dubai was precisely the market where AI should be applied today. From October 2022 to October 2023, we sold 350 apartments in Dubai worth $130 million and earned $7 million in revenue in the first year. The company's valuation in Dubai was estimated at over $50 million by investors, and the 15% stake was worth more than $7.5 million. This investor is Maxim @kuchinmaksim (Telegram), who later joined the company and founded a department within the company to work with real estate agents (they can use our infrastructure and conduct transactions, generating $1.3 million in revenue in the first year).

Public track record is here : https://deals.realiste.ai/

The local success in Dubai encouraged both current and new investors to open cities and reserve locations for themselves (if it worked so successfully in Dubai, it could work just as well in Berlin, Moscow, Jakarta, and so on). Currently, Realiste's models are deployed in 114 cities, SEED investments have been secured in 15 cities, transactions are taking place in 5 cities (Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Bali), and in 2024, the plan is to secure SEED investments in 40 cities (ranging from $200,000 to $500,000), conduct transactions in 15 cities, and have models deployed

Current Business Metrics for the First Year of Operations in the UAE

Plans and Future Products

Currently, we provide API services and are beginning to offer White Label solutions. In Dubai, we are exploring the possibility of selling our developed AI strategies, although this is still in the discussion phase (we are already receiving interest from interested strategists). We plan to replicate the success we achieved in Dubai in several other locations in 2024, leveraging our experience, lack of competition, and significant market opportunities. We are also initiating collaborations with major companies for the integration of our AI (Artificial Intelligence as a Service, AIaaS). Our goal for 2024 is to increase revenue from $7 million to $35 million by expanding language groups and increasing the marketing budget. We have learned how to hire salespeople in large numbers, so that is not a problem. Additionally, we aim to start generating revenue from other locations at a level exceeding $1-2 million per year.

If You're Interested in Launching a Similar Project Anywhere in the World: Please follow the link at map.realiste.ai for further discussions. We are currently raising SEED funding and seeking co-founders in over 100 cities.

For Professional Investors Interested in Investing in Our Company: Contact information is provided below.

The company's goal is to create super intelligence (smarter than any human, real estate agent, or analyst, with access to 10,000 times more data and covering 100 times more cities) in the real estate market. The idea is to provide this AI to users for free (open access to some features, full functionality to be provided to B2B partners), while earning revenue through B2B channels (commissions from sales, integrating AI into businesses). The business model resembles that of Google. Currently, Realiste's platform includes data for 114 cities worldwide, 20,000 annotated districts, 20 macroeconomic indicators, and in the UAE, there are 20 layers of data and cross-sections (rental ROI, prices, green area, forecasts, etc.), 15 ratings for over 200 developers and 700 projects. Every day, over 2 million ads pass through the Realiste engine. All this data is updated either daily or weekly (for macro data), and all of it is free, used by our AI to provide forecasts and recommendations to clients. Our products are currently used by developers and banks, and there are free products for users. Realiste currently holds the world's largest real estate database (excluding the United States).

Brief Development History

I started betting on algorithms against human expertise in 2015 when I encountered the limitation of my investment analytics being confined to knowledge of just one district. Real estate agents were similarly restricted to one location (the same person could not provide accurate information about two different districts or two cities), and in 90% of cases, the expertise of real estate agents in investments was lacking. At that time, I had a real estate agency and was investing in land plots. Initially, like many others, it was a complex Excel spreadsheet with hundreds of variables. Then, with the help of developers, we transformed it into products. By 2019, we were putting all our efforts into training our first ML model.

We developed parallel models for different cities: New York (and 10 other cities in the US), Moscow, and Hong Kong as we traveled the world and studied the experiences of these locations.

From 2015 to 2020, we attempted to attract investments into this idea and were unsuccessful in securing VC investments anywhere (we pitched about 250 times, even multiple times to some because they forgot about us, and I pitched to one guy from the largest VC fund in the US three times in five years).

At the beginning of the pandemic, we returned from the US to Moscow and launched an open product in Moscow (users could find apartments in Moscow at 15% below market prices). This product attracted many users, and it was these users who invested money in the company.

A total of 60 angel users of the platform invested over 6 million dollars from 2020 to 2023 and continue to invest in the company. We came up with the idea of integrating AI into banks and developers in Russia, and we spent two years trying to do so. In two years, we integrated AI into various products in the 20 largest companies and earned only 10 million rubles (which wasn't worth the effort, of course). Meanwhile, users continued to use our platform and invest money in us.

Then the war in Ukraine happened, and we decided to leave for Saudi Arabia (because we always wanted to build an international business, and it was no longer possible to do so from Russia). We abandoned everything we had done in Russia (there wasn't much to leave behind, and integrating AI into banks and developers wasn't what a startup should be doing in Russia). At that moment, we were offered to sell 15% of the company in Dubai (where we had no initial plans to develop) for $700,000 and launch a product in Dubai. We launched the product in Dubai, came to adapt, and realized that Dubai was precisely the market where AI should be applied today. From October 2022 to October 2023, we sold 350 apartments in Dubai worth $130 million and earned $7 million in revenue in the first year. The company's valuation in Dubai was estimated at over $50 million by investors, and the 15% stake was worth more than $7.5 million. This investor is Maxim @kuchinmaksim (Telegram), who later joined the company and founded a department within the company to work with real estate agents (they can use our infrastructure and conduct transactions, generating $1.3 million in revenue in the first year).

Public track record is here : https://deals.realiste.ai/

The local success in Dubai encouraged both current and new investors to open cities and reserve locations for themselves (if it worked so successfully in Dubai, it could work just as well in Berlin, Moscow, Jakarta, and so on). Currently, Realiste's models are deployed in 114 cities, SEED investments have been secured in 15 cities, transactions are taking place in 5 cities (Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, Bali), and in 2024, the plan is to secure SEED investments in 40 cities (ranging from $200,000 to $500,000), conduct transactions in 15 cities, and have models deployed

Current Business Metrics for the First Year of Operations in the UAE

- Sales: Sold properties worth $121 million, primarily to Russian-speaking clients. It's important to note that the Russian-speaking market declined by 4-5 times from March 2023 onwards, but our sales remained at a steady level. If the market hadn't declined, we could have achieved sales four times greater. Unfortunately, we didn't have the chance to shift towards English-speaking clients in 2023, but we are targeting five languages for 2024 in the UAE.

- Revenue: Earned $7 million, reaching self-sufficiency in the UAE.

- Online Transactions: Achieved $5 million in sales without the involvement of real estate agents, purely through online transactions. AI helped with analysis, and the support team assisted clients with transactions. These sales were conducted remotely, with no real estate agents participating. This achievement is remarkable, as few believed it was possible. Thanks to having all data and expertise on the platform, the need for a real estate agent's expertise, especially in investments, was eliminated. This allowed us to close deals through customer support and remote sales. The margin for such a business is 63% after accounting for marketing and sales expenses.

- Additional Revenue: Generated an additional $1.3 million through a scheme where real estate agents utilize the platform and our infrastructure to close their deals. In this scheme, we pay real estate agents 91% of the commission, retaining 9% for ourselves.

Plans and Future Products

Currently, we provide API services and are beginning to offer White Label solutions. In Dubai, we are exploring the possibility of selling our developed AI strategies, although this is still in the discussion phase (we are already receiving interest from interested strategists). We plan to replicate the success we achieved in Dubai in several other locations in 2024, leveraging our experience, lack of competition, and significant market opportunities. We are also initiating collaborations with major companies for the integration of our AI (Artificial Intelligence as a Service, AIaaS). Our goal for 2024 is to increase revenue from $7 million to $35 million by expanding language groups and increasing the marketing budget. We have learned how to hire salespeople in large numbers, so that is not a problem. Additionally, we aim to start generating revenue from other locations at a level exceeding $1-2 million per year.

If You're Interested in Launching a Similar Project Anywhere in the World: Please follow the link at map.realiste.ai for further discussions. We are currently raising SEED funding and seeking co-founders in over 100 cities.

For Professional Investors Interested in Investing in Our Company: Contact information is provided below.

Why did you write this article and disclose this information? I share parts of this material with employees, investors, partners in various countries, real estate agents, and more on a daily basis. I calculated that if I spend 20 hours on this article, I'll save myself 300 hours per year (the ROI is over 10X, so I decided to do it). If this information benefits our competitors, that's not a concern. In this field, the most important thing is to move faster and faster, and competitors can start by using our API to save years of their lives on what I've already accomplished. Plus, I believe this article will spread to people interested in the topic in various languages and attract the right talented individuals to our company.

Is it easy to create AI in real estate? No, it's not easy at all. It's easy to create AI when you have abundant, clean data. However, in real estate, data is scarce and often messy. You need to invent methods to solve these problems first. If it were easy, everyone would already have done it.

Isn't this just a retrospective analysis of historical data? Some might say this, even claiming they work in AI at OpenAI or Facebook and that creating such a system would only take a couple of weeks. I've heard it many times over 8 years. Please, tell me a company where I can go and see how it works. If it's that easy, folks, don't sit around. This field holds over $100 billion; you should get to work on it urgently.

But analyzing past prices won't predict future prices. Exactly! Predicting future prices or assessing real estate solely based on historical data is not the path to a good product. You can derive correlations and some insights about market behavior from the past, but predicting and evaluating based only on this data won't work.

What will real estate agents say? They might argue that AI won't affect them. They believe that for people, buying real estate is a significant decision that requires a real expert to explain and guide them through the process. True professionals will always be in demand.

Real estate agents should embrace AI. Real estate agents should urgently delve into AI because, firstly, it can earn them much more money. Secondly, those who don't adapt will end up working with clients who are 70+ years old or those who still use basic phones very soon.

What will old-school real estate investors say? They might ask about taxes and dividends, and mention that the costs of sales and real estate agents were not included in the calculations. Friends, we work in multiple markets, and taxes and expenses vary. My goal was to provide a high-level description of the market's workings and opportunities for investors. If you believe something was overlooked, feel free to use my data and make your own calculations.

Is it easy to create AI in real estate? No, it's not easy at all. It's easy to create AI when you have abundant, clean data. However, in real estate, data is scarce and often messy. You need to invent methods to solve these problems first. If it were easy, everyone would already have done it.

Isn't this just a retrospective analysis of historical data? Some might say this, even claiming they work in AI at OpenAI or Facebook and that creating such a system would only take a couple of weeks. I've heard it many times over 8 years. Please, tell me a company where I can go and see how it works. If it's that easy, folks, don't sit around. This field holds over $100 billion; you should get to work on it urgently.

But analyzing past prices won't predict future prices. Exactly! Predicting future prices or assessing real estate solely based on historical data is not the path to a good product. You can derive correlations and some insights about market behavior from the past, but predicting and evaluating based only on this data won't work.

What will real estate agents say? They might argue that AI won't affect them. They believe that for people, buying real estate is a significant decision that requires a real expert to explain and guide them through the process. True professionals will always be in demand.

Real estate agents should embrace AI. Real estate agents should urgently delve into AI because, firstly, it can earn them much more money. Secondly, those who don't adapt will end up working with clients who are 70+ years old or those who still use basic phones very soon.

What will old-school real estate investors say? They might ask about taxes and dividends, and mention that the costs of sales and real estate agents were not included in the calculations. Friends, we work in multiple markets, and taxes and expenses vary. My goal was to provide a high-level description of the market's workings and opportunities for investors. If you believe something was overlooked, feel free to use my data and make your own calculations.

Contacts:

Alex Galt