Realiste Head Office

Dubai, Central Park Towers, DIFC level 16: Office 16-36

Contact us

Article by Alex galt

10 Dec 2023

10 Dec 2023

The $1 trillion AI revolution in Real Estate is happening now. How to profit from it?

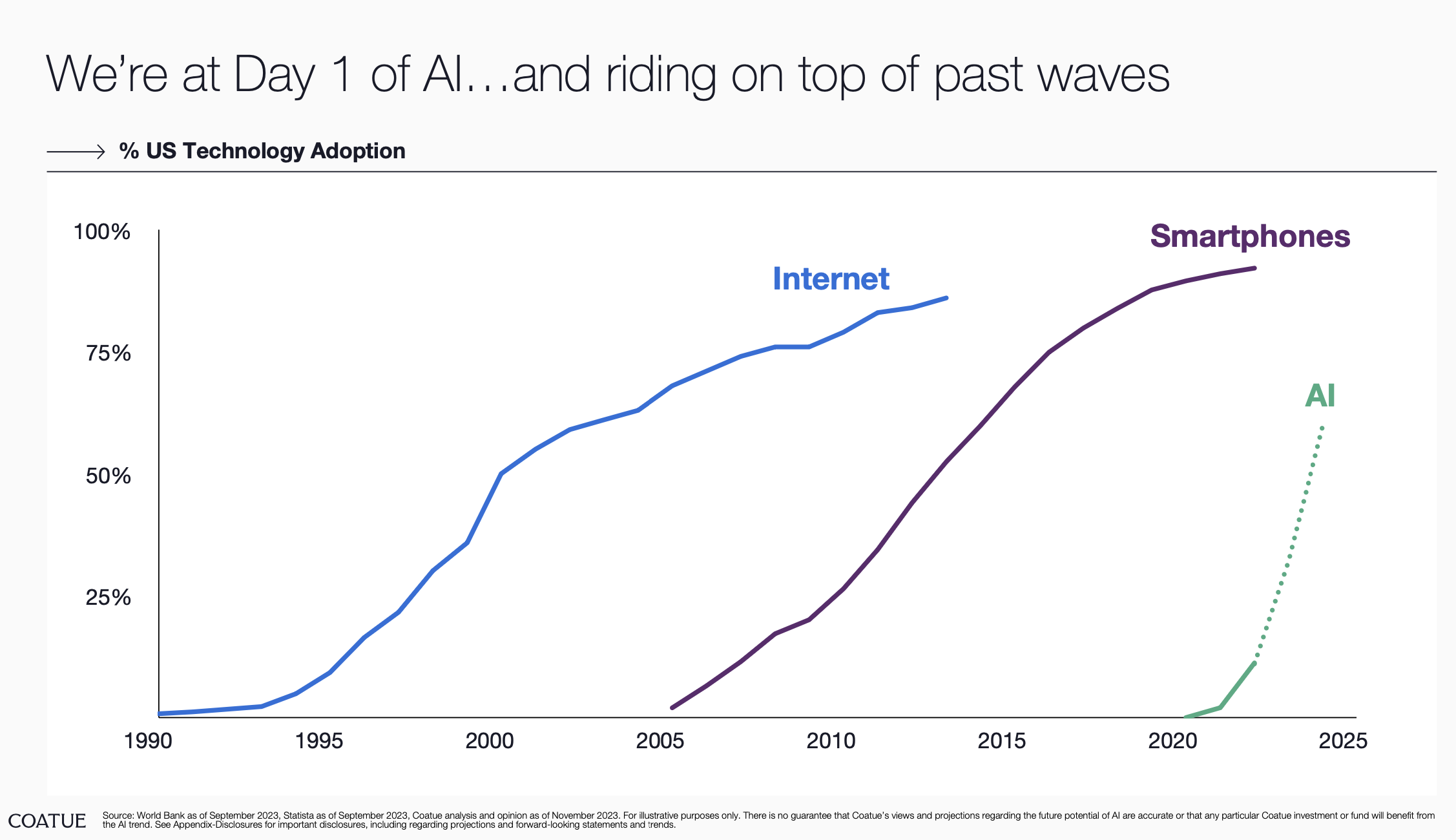

Artificial Intelligence is soaring and growing at a rate several times faster than the Internet and smartphones. Is AI just a hype? Drawing upon eight years of experience in real estate AI, along with insights from numerous studies and reports, this article by Alex Galt offers unique perspectives that can't be found elsewhere. With demonstrated benefits, AI is positioned to endure and redefine various markets in the coming years.

5 Brief Theses on How AI Will Impact Real Estate and All of Us:

- $1 trillion in investments will be redistributed among cities over the next approximately 5-10 years.

- Over 30% of realtors will change their jobs.

- Up to 100 million people globally will relocate in 5-10 years.

- Tens of thousands of new dollar millionaires will emerge soon.

- Over the next five years, AI will act as a catalyst for creating approximately 100 new billionaires, free humanity from many unnecessary actions, and facilitate the redistribution of resources into new areas vital for humanity.

New Opportunities That Didn't Exist Before

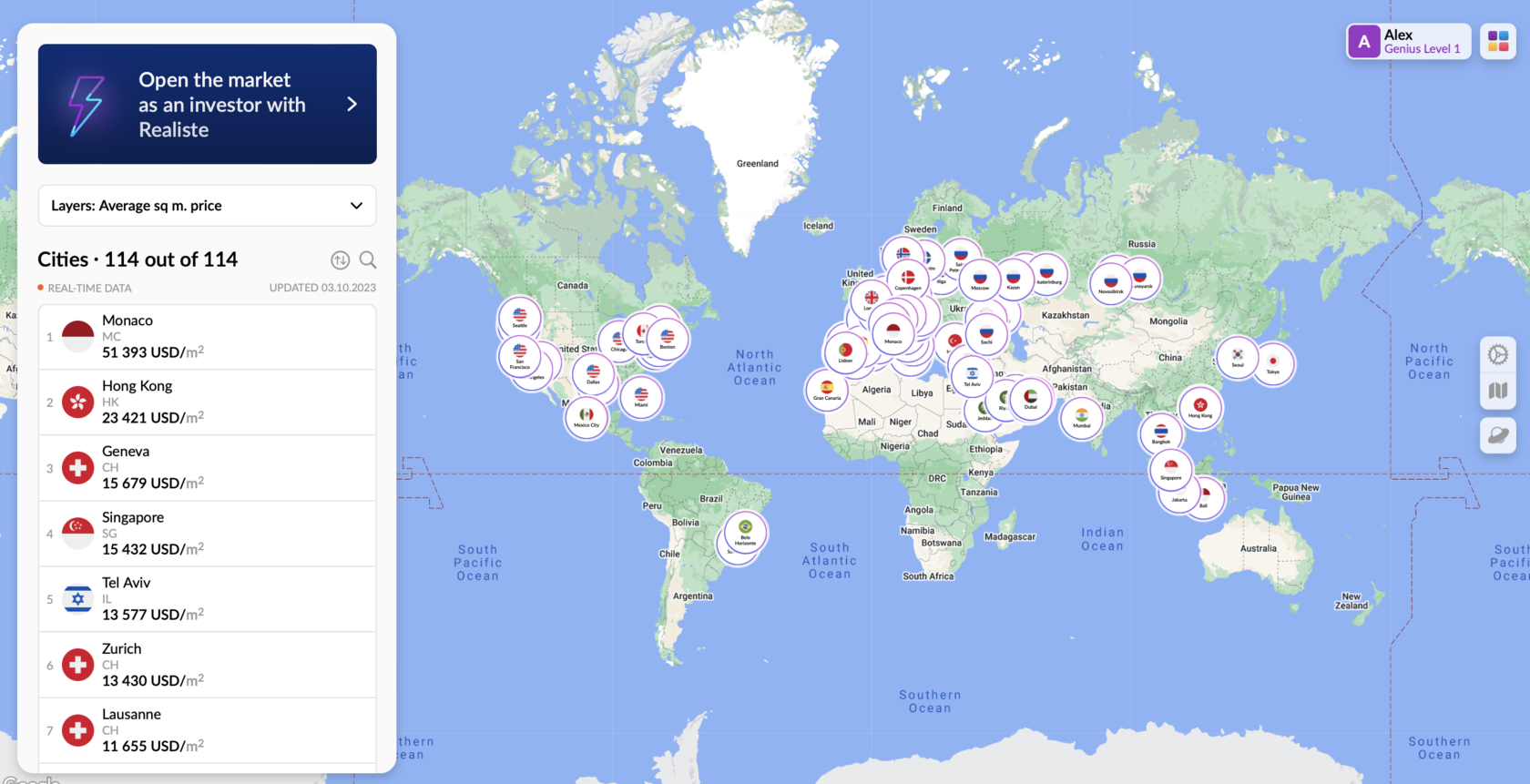

Most people buy real estate where they were born or where they have lived most of their lives. The lack of data on other locations and opportunities narrows people's choices to what they know and understand. Although at any given moment there are the top 10% of cities or locations in the world that are the best to live or invest in, logically 90% of people are unaware of this, otherwise, they would be buying real estate exactly there. Thus, in real estate, there exists a global geographical arbitrage worth trillions of dollars

In London's cheapest area, Barking, average prices are $6161 per square meter for low-quality real estate, located 1 hour away from the city center in a high-crime area with a 35%+ tax and $6000 live spending/m. In contrast, the neighborhood "Hartland" in Dubai, just 10 minutes from the city center with zero crime, zero tax, and $4000 live spending/m, offers business-class homes (pool, doorman, gym, lobby) at $6225 per square meter. The cost difference is substantial, with the price/quality ratio showing a 300% difference between these locations. This suggests that property owners in Barking could potentially sell their houses, buy three similar ones in Dubai, rent out two of them, and achieve financial independence through rental income.

Most people buy real estate where they were born or where they have lived most of their lives. The lack of data on other locations and opportunities narrows people's choices to what they know and understand. Although at any given moment there are the top 10% of cities or locations in the world that are the best to live or invest in, logically 90% of people are unaware of this, otherwise, they would be buying real estate exactly there. Thus, in real estate, there exists a global geographical arbitrage worth trillions of dollars

In London's cheapest area, Barking, average prices are $6161 per square meter for low-quality real estate, located 1 hour away from the city center in a high-crime area with a 35%+ tax and $6000 live spending/m. In contrast, the neighborhood "Hartland" in Dubai, just 10 minutes from the city center with zero crime, zero tax, and $4000 live spending/m, offers business-class homes (pool, doorman, gym, lobby) at $6225 per square meter. The cost difference is substantial, with the price/quality ratio showing a 300% difference between these locations. This suggests that property owners in Barking could potentially sell their houses, buy three similar ones in Dubai, rent out two of them, and achieve financial independence through rental income.

With thorough data gathering and understanding of people's behavioral strategies, there may be opportunities for low-risk, high-reward trading in the real estate market.

And this is not just an example of Dubai and London. On the platform, you can find hundreds of similar examples in 114 cities, with over 20,000 neighborhoods where you can move from a less desirable neighborhood in an old city to a fantastic neighborhood in a new or lesser-known city and receive a substantial cash bonus. Moreover, the safety and infrastructure at the new location may be even better.

And this is not just an example of Dubai and London. On the platform, you can find hundreds of similar examples in 114 cities, with over 20,000 neighborhoods where you can move from a less desirable neighborhood in an old city to a fantastic neighborhood in a new or lesser-known city and receive a substantial cash bonus. Moreover, the safety and infrastructure at the new location may be even better.

AI is crucial for identifying the most promising real estate markets and opportunities by analyzing vast data sets, offering insights that human analysts cannot match in predicting growth across numerous neighborhoods and cities.

How to Profit from This

Currently, only a small number of people are aware of the existence of AI in real estate, giving a significant advantage over the market and other participants. However, in a couple of years, these opportunities will become more commonplace, and the potential income from their use will become more modest. As more people begin to utilize these tools, the advantage of their individual use will diminish.

Below, I outline what I believe are the most promising opportunities for profiting in this field:

In real estate, AI opens up two intriguing investment strategies that were previously nearly inaccessible. Each of these strategies has the potential to grow capital from $1 million (insert your amount) to 10 times that amount (up to $10 million) throughout 5 to 10 years.

Currently, only a small number of people are aware of the existence of AI in real estate, giving a significant advantage over the market and other participants. However, in a couple of years, these opportunities will become more commonplace, and the potential income from their use will become more modest. As more people begin to utilize these tools, the advantage of their individual use will diminish.

Below, I outline what I believe are the most promising opportunities for profiting in this field:

In real estate, AI opens up two intriguing investment strategies that were previously nearly inaccessible. Each of these strategies has the potential to grow capital from $1 million (insert your amount) to 10 times that amount (up to $10 million) throughout 5 to 10 years.

Strategy 1 - Buying at a Discount and Reselling at Market Price

You can use AI to identify real estate properties that are selling at a discount or considered overvalued. After purchasing such real estate and waiting for its value to increase, you can resell it at market price, generating a profit.

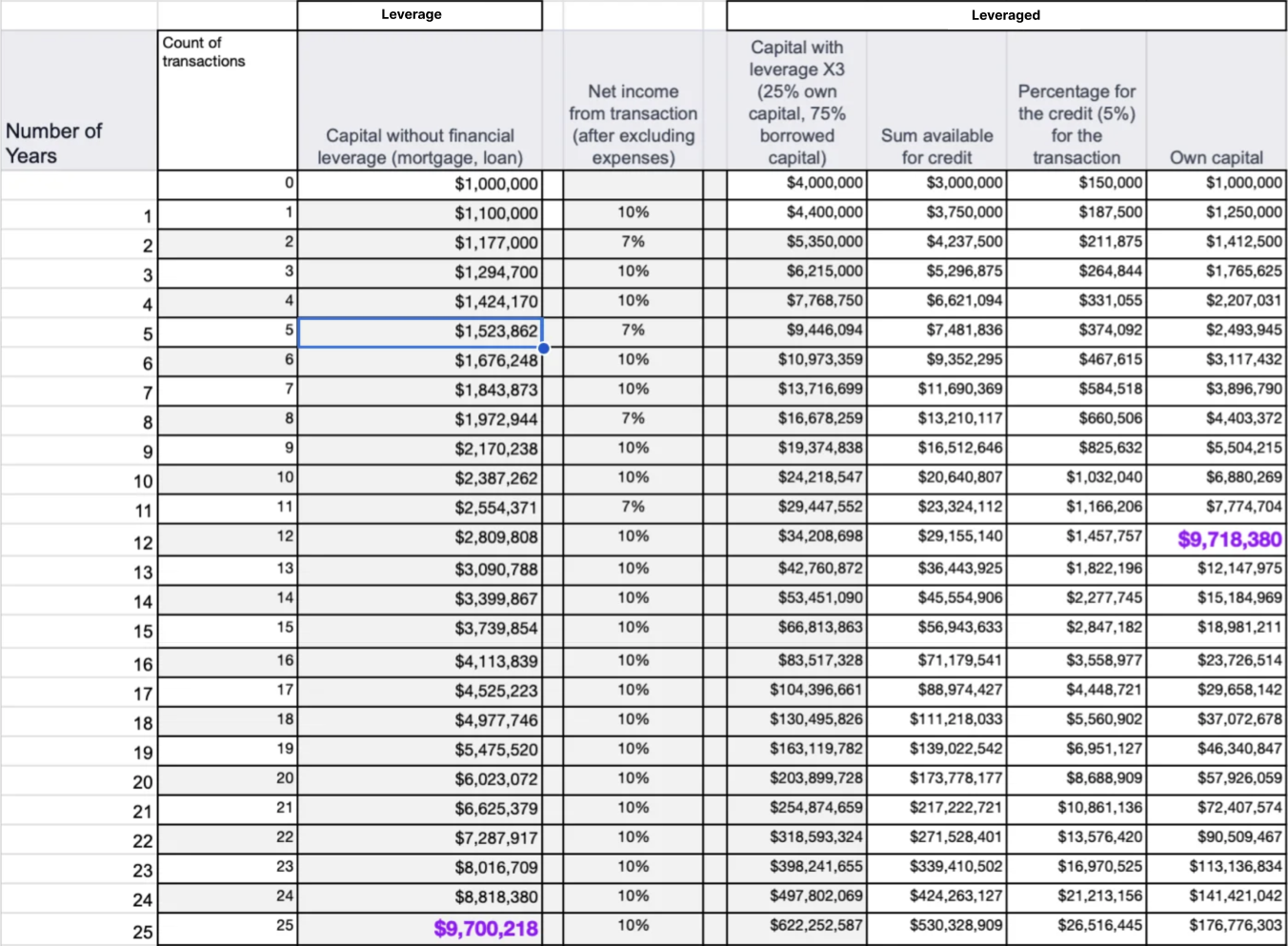

The essence of the strategy is to find real estate that is priced 15% below the market value: 10% for profit and 5% to cover transaction costs and taxes. Regardless of market fluctuations, the goal is to sell such real estate at its market value. The faster the sale occurs, the better: if the cycle takes not a year but 6 months, you can increase the amount from $1 million to $10 million in 25 transactions, or in 12 years. With the use of financial leverage, this can be achieved in 12 transactions and in 5-6 years. Real estate can be found and sold without making improvements; you can calculate the value after renovations, taking into account investments - this is not essential. The key point is that AI can calculate this more efficiently and is already actively doing so.

Please note that taxes and expenses related to the sale or search for such real estate should be added on top of your calculations (I didn't mention this because different markets have different expenses and taxes).

AI can and is already being used to create a real estate pipeline with discounts. This is achieved through automated valuation models, where each property entering the market undergoes an assessment and enters the pipeline.

However, after five years of working on AI development, we have concluded that such a business model may seem dull. It requires a lot of movement and activity and is often more suitable for small companies. When working with a substantial amount of data, a large number of human resources is needed. Moreover, such models are rarely funded by banks, and non-banking capital is not always available in many countries around the world. For example, in Russia or the UAE, there are no financial products similar to Hard Money Loans, representing a $30 billion industry in the US.

You can use AI to identify real estate properties that are selling at a discount or considered overvalued. After purchasing such real estate and waiting for its value to increase, you can resell it at market price, generating a profit.

The essence of the strategy is to find real estate that is priced 15% below the market value: 10% for profit and 5% to cover transaction costs and taxes. Regardless of market fluctuations, the goal is to sell such real estate at its market value. The faster the sale occurs, the better: if the cycle takes not a year but 6 months, you can increase the amount from $1 million to $10 million in 25 transactions, or in 12 years. With the use of financial leverage, this can be achieved in 12 transactions and in 5-6 years. Real estate can be found and sold without making improvements; you can calculate the value after renovations, taking into account investments - this is not essential. The key point is that AI can calculate this more efficiently and is already actively doing so.

Please note that taxes and expenses related to the sale or search for such real estate should be added on top of your calculations (I didn't mention this because different markets have different expenses and taxes).

AI can and is already being used to create a real estate pipeline with discounts. This is achieved through automated valuation models, where each property entering the market undergoes an assessment and enters the pipeline.

However, after five years of working on AI development, we have concluded that such a business model may seem dull. It requires a lot of movement and activity and is often more suitable for small companies. When working with a substantial amount of data, a large number of human resources is needed. Moreover, such models are rarely funded by banks, and non-banking capital is not always available in many countries around the world. For example, in Russia or the UAE, there are no financial products similar to Hard Money Loans, representing a $30 billion industry in the US.

Pros of the strategy:

- It is possible and works in any market, especially where there are no or deferred capital gains taxes (e.g., the 1031 exchange in the United States or in the UAE before the introduction of the 9% profit tax in 2023).

- Particularly effective in markets with well-developed financing options for such deals, such as the United States, England, Australia, and others

- Continuously searching for such properties without software assistance can be challenging since there are not many property owners willing to sell at a 15% discount.

- It requires a high volume of transactions to grow capital, which can be resource-intensive.

Strategy 2 - Smart Market and Project Selection

The second strategy that can lead to an increase in capital from 1 million to 10 million dollars involves making the right choices for just two projects over 10 years. This means selecting a market where the growth over 5 years would be approximately as follows:

For example, Dubai's real estate market has been demonstrating an average annual price growth of 15% since 2020. Currently, in 2024, the growth is around 11%. Some projects in Dubai have shown growth of 400% since 2020. The best projects within the top 10% over the last 4 years have exhibited an average annual growth rate of more than 30%. This Dubai example illustrates that finding a market and project with high growth rates is entirely possible with the right choices while avoiding risks related to defaults or property destruction.

Taxes and expenses related to the sale or search for such property should be added on top of these calculations.

The second strategy that can lead to an increase in capital from 1 million to 10 million dollars involves making the right choices for just two projects over 10 years. This means selecting a market where the growth over 5 years would be approximately as follows:

- 15% in the first year,

- 15% in the second year,

- 11% in the third year,

- 7% in the fourth year,

- 5% in the fifth year.

For example, Dubai's real estate market has been demonstrating an average annual price growth of 15% since 2020. Currently, in 2024, the growth is around 11%. Some projects in Dubai have shown growth of 400% since 2020. The best projects within the top 10% over the last 4 years have exhibited an average annual growth rate of more than 30%. This Dubai example illustrates that finding a market and project with high growth rates is entirely possible with the right choices while avoiding risks related to defaults or property destruction.

Taxes and expenses related to the sale or search for such property should be added on top of these calculations.

Under such a strategy, it's crucial to make two correct project selections over 10 years. The actions involve:

Important Notes:

In both the first and second strategies, it's crucial to:

Conclusion

Can AI significantly increase the chances of successfully selecting the market and project? Absolutely. By analyzing all markets and projects, AI can compare prospects in different locations, which is not feasible for humans due to the vast amount of information. AI can also predict when the market's potential is diminishing and it's time to exit a project. This becomes noticeable in advance on the AI's dashboard and forecasts regarding market and project prospects.

In my estimation, by 2025, more than 50% of users will already be informed about AI in real estate. By 2030, not using AI in real estate decision-making will be as unusual as driving without a navigator is today. By that time, the quality of AI recommendations and insights will either be on par with the top 1% of experts or even surpass them.

Creating AI in real estate, as Realiste did, is challenging due to the scarcity and complexity of data. The process requires overcoming obstacles related to data quality and abundance, making it a complex endeavor that not everyone has accomplished.

If you're interested in AI in real estate and want to learn more, feel free to reach out to our founding team.

- Buying one property and, after a year, evaluating it to gain extra funds from its increased value. You then purchase another property in the same market (or project) and continue this process for five years.

- In the fifth year, you sell everything and invest in market #2 (or project #2), and repeat the process for another five years.

Important Notes:

In both the first and second strategies, it's crucial to:

- Make the right project selection.

- When buying during the construction phase, avoid defaults (choosing markets with escrow accounts is one option).

- Consider entrusting additional due diligence of the developer to AI, which can reduce these risks but not eliminate them.

- Refinance promptly and buy additional properties in the same project when necessary.

Conclusion

Can AI significantly increase the chances of successfully selecting the market and project? Absolutely. By analyzing all markets and projects, AI can compare prospects in different locations, which is not feasible for humans due to the vast amount of information. AI can also predict when the market's potential is diminishing and it's time to exit a project. This becomes noticeable in advance on the AI's dashboard and forecasts regarding market and project prospects.

In my estimation, by 2025, more than 50% of users will already be informed about AI in real estate. By 2030, not using AI in real estate decision-making will be as unusual as driving without a navigator is today. By that time, the quality of AI recommendations and insights will either be on par with the top 1% of experts or even surpass them.

Creating AI in real estate, as Realiste did, is challenging due to the scarcity and complexity of data. The process requires overcoming obstacles related to data quality and abundance, making it a complex endeavor that not everyone has accomplished.

If you're interested in AI in real estate and want to learn more, feel free to reach out to our founding team.